Car Insurance Policy:

Basics of Car Insurance Coverage

When it comes to protecting your vehicle and your financial well-being on the road, car insurance stands as a mandatory asset. Understanding the intricacies of your car insurance policy is paramount in ensuring comprehensive coverage. At [your company name], we prioritize empowering our customers with knowledge to make informed decisions about their auto insurance needs. Car Insurance Policy

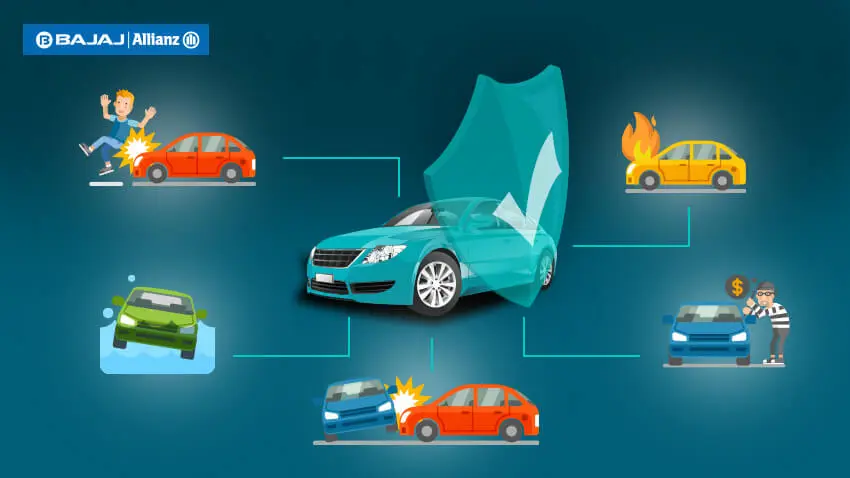

Types of Car Insurance Coverage

Liability Coverage: Protecting Yourself and Others

When it comes to protecting your vehicle and your financial well-being on the road, car insurance stands as a mandatory asset. Understanding the intricacies of your car insurance policy is paramount in ensuring comprehensive coverage. At [your company name], we prioritize empowering our cus Car Insurance Policytomers with knowledge to make informed decisions about their auto insurance needs.

Collision Coverage: Safeguarding Your Vehicle

When it comes to the safety of your vehicle and your financial well-being on the road, car insurance stands as a mandatory asset. Understanding the intricacies of your car insurance policy is paramount in ensuring comprehensive coverage. At [your company name], we prioritize empowering our customers with knowledge to make informed decisions about their auto insurance needs. Car Insurance Policy

Comprehensive Coverage: Shielding Against Non-Collision Incidents

When it comes to the safety of your vehicle and your financial well-being on the road, car insurance is a mandatory asset. Understanding the intricacies of your car insurance policy is paramount in ensuring comprehensive coverage. At [your company name], we prioritize empowering our customers with knowledge to make informed decisions about their auto insurance needs. Car Insurance Policy

Personal Injury Protection (PIP) and Medical Payments Coverage

When it comes to the safety of your vehicle and your financial well-being on the road, car insurance is a mandatory asset. Understanding the intricacies of your car insurance policy is paramount in ensuring comprehensive coverage. At [your company name], we prioritize empowering our customers with knowledge to make informed decisions about their auto insurance needs.

Uninsured/Underinsured Motorist Coverage: Ensuring Protection in Hit-and-Run Incidents

In the unfortunate event of an accident with an uninsured or underinsured driver, uninsured/underinsured motorist coverage takes steps to cover medical expenses, lost wages and vehicle repairs, providing the necessary protection when the other party lacks adequate coverage.

Factors Influencing Car Insurance Premiums

Driving Record: The Impact of Your Driving History

In the unfortunate event of an accident with an uninsured or underinsured driver, uninsured/underinsured motorist coverage takes steps to cover medical expenses, lost wages and vehicle repairs, providing the necessary protection when the other party lacks adequate coverage.

Vehicle Type: Evaluating Insurance Risk

In the unfortunate event of an accident with an uninsured or underinsured driver, uninsured/underinsured motorist coverage takes steps to cover medical expenses, lost wages and vehicle repairs, providing the necessary protection when the other party lacks adequate coverage.

Location: Assessing Regional Risk Factors

In the unfortunate event of an accident with an uninsured or underinsured driver, uninsured/underinsured motorist coverage takes steps to cover medical expenses, lost wages and vehicle repairs, providing the necessary protection when the other party lacks adequate coverage.

Coverage Limits and Deductibles: Finding the Right Balance

In the unfortunate event of an accident with an uninsured or underinsured driver, uninsured/underinsured motorist coverage takes steps to cover medical expenses, lost wages and vehicle repairs, providing the necessary protection when the other party lacks adequate coverage.

Maximizing Savings on Your Car Insurance Policy

Bundle Your Policies: Consolidating for Cost Savings

In the unfortunate event of an accident with an uninsured or underinsured driver, uninsured/underinsured motorist coverage takes steps to cover medical expenses, lost wages and vehicle repairs, providing the necessary protection when the other party lacks adequate coverage.

Take Advantage of Discounts: Exploring Available Options

In the unfortunate event of an accident with an uninsured or underinsured driver, uninsured/underinsured motorist coverage takes steps to cover medical expenses, lost wages and vehicle repairs, providing the necessary protection when the other party lacks adequate coverage.

Maintain a Good Credit Score: Demonstrating Financial Responsibility

Maintaining a good credit score not only reflects your financial responsibility but can also result in lower car insurance premiums. Insurers often use credit-based insurance scores as a factor in determining rates.

Drive Safely and Responsibly: Avoiding Accidents and Violations

Maintaining a clean driving record is one of the most effective ways to keep your auto insurance premiums low. Avoiding accidents, traffic violations, and DUI convictions demonstrates your commitment to safe driving practices.

Conclusion

Maintaining a good credit score not only reflects your financial responsibility but can also result in lower car insurance premiums. Insurers often use credit-based insurance scores as a factor in determining rates.

Embracing Technological Advancements in Car Insurance

Telematics and Usage-Based Insurance

Maintaining a good credit score not only reflects your financial responsibility but can also result in lower car insurance premiums. Insurers often use credit-based insurance scores as a factor in determining rates.

Mobile Apps for Convenience and Accessibility

Maintaining a good credit score not only reflects your financial responsibility but can also result in lower car insurance premiums. Insurers often use credit-based insurance scores as a factor in determining rates.

The Importance of Regular Policy Reviews

As your circumstances change over time, periodically reviewing your car insurance policy is essential to ensure it still meets your needs. Life events such as buying a new car, moving to a different location, or adding a teenage driver to your policy can all affect your insurance needs.

Final Thoughts

As your circumstances change over time, periodically reviewing your car insurance policy is essential to ensure it still meets your needs. Life events such as buying a new car, moving to a different location, or adding a teenage driver to your policy can all affect your insurance needs.

4 thoughts on “Car Insurance Policy”